The International Sustainability Standards Board (ISSB) is a global standard-setting body that aims to develop and promote a comprehensive global baseline for sustainability-related financial disclosures. The ISSB plays a crucial role in creating a standardized approach for sustainability reporting, helping companies provide consistent and transparent sustainability-related financial information.

The ISSB was established by the IFRS Foundation in November 2021 at the UN Climate Change Conference (COP26). The IFRS Foundation announced the formation of the ISSB as part of its global sustainability initiative. The ISSB builds on the Value Reporting Foundation and other existing reporting frameworks, including the Sustainability Accounting Standards Board (SASB), which originated in San Francisco, to create a more efficient reporting landscape for companies and investors. The ISSB works closely with global regulators, businesses, and investors to ensure its standards align with financial markets’ needs. The Beijing office serves as a key hub for implementing and promoting ISSB standards and sustainability disclosures in the Chinese and broader Asian markets.

What is the ISSB’s role?

The ISSB’s role is to address the fragmentation in sustainability matters by creating a standardized approach to sustainability-related financial disclosures. Investors and stakeholders have long sought a globally consistent framework that enables integrated reporting of sustainability risks and opportunities. The ISSB’s standards complement existing IFRS Foundation financial reporting standards to provide transparency and comparability across markets, operating in the public interest to ensure transparency and accountability for a wide range of stakeholders.

The ISSB is backed by the G20, the International Organisation of Securities Commissions (IOSCO), the Financial Stability Board, and the World Economic Forum. ISSB Chair Emmanuel Faber has stated, “We responded to capital market and G20 demand for a common language of investor-focused, sustainability-related disclosure, working diligently to deliver standards that fulfill the global baseline.” The ISSB’s leadership structure includes a Chair and one or two Vice Chairs. Sue Lloyd serves as Vice Chair, playing a key role in the creation and early development of the ISSB and providing leadership alongside the Chair.

The ISSB continues to refine its sustainability-related disclosure standards to align with global reporting requirements and investor needs. The development of these standards involves active participation from various standard setters and stakeholders, ensuring broad engagement and alignment in sustainability reporting.

What are the ISSB standards?

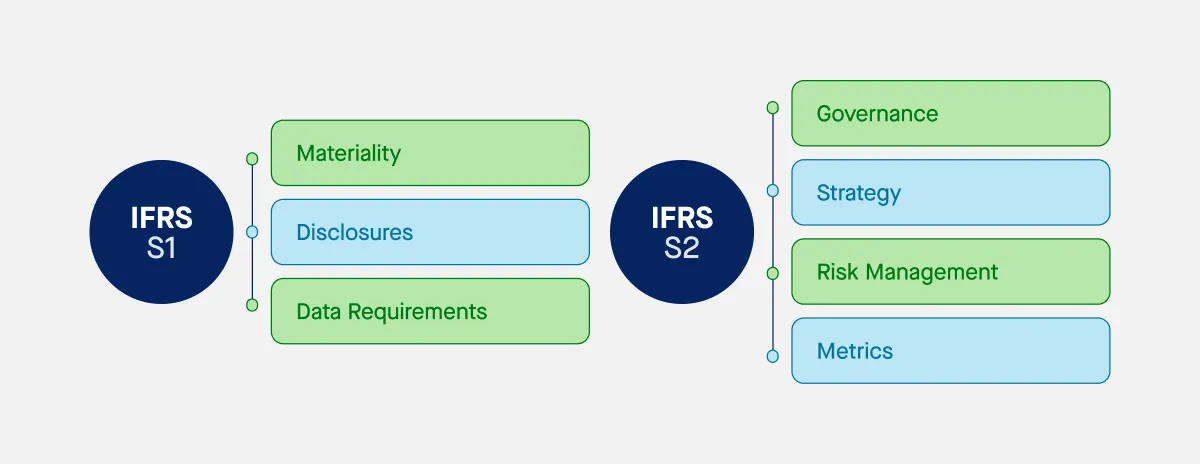

General sustainability disclosures (IFRS S1)

IFRS S1 requires companies to disclose material sustainability matters, drawing from the Sustainability Accounting Standards Board (SASB) framework and integrating integrated reporting principles. Organizations must report on significant sustainability-related risks and opportunities, tailored to their sector. The use of industry based guidance is essential to ensure that disclosures are relevant and consistent across different industries. These disclosures must cover governance structures, sustainability-related risk management, and the financial impact of sustainability-related financial information on business operations.

The ISSB emphasizes that IFRS S1 is designed to be industry-agnostic, allowing companies across different sectors to use a common framework. The standard aims to ensure that sustainability-related financial disclosures align with investor needs and IFRS Standards, reflecting the influence of the International Accounting Standards Board in shaping both financial and sustainability reporting frameworks. This alignment makes it easier for stakeholders to assess companies’ long-term viability.

Climate disclosure standards (IFRS S2)

The IFRS S2 Climate-related Disclosures align with the Task Force on Climate-related Financial Disclosures (TCFD) framework. This standard requires organizations to disclose climate-related risks and opportunities based on governance, strategy, risk management, metrics, and targets.

IFRS S2 mandates organizations to assess their exposure to physical and transition climate risks. This includes:

- How climate-related risks affect their financial position and business model

- Climate risk mitigation strategies and adaptation plans

- Reporting on scope 1, 2, and 3 greenhouse gas emissions

- Financial resilience testing under different climate scenarios

- Disclosure of internal carbon pricing mechanisms

Organizations are also required to disclose their climate related targets and transition plans, ensuring transparency and accountability in setting and achieving measurable climate goals in line with IFRS S2.

Digital taxonomies, including IFRS digital taxonomies, play a crucial role in structuring and standardizing climate-related disclosures. They enable organizations to report sustainability and climate data in a consistent, comparable, and high-quality digital format, supporting the implementation of IFRS S2 and enhancing transparency across markets.

With IFRS S2, the ISSB aims to provide capital markets with clear and consistent climate-related financial disclosures, ensuring that investors can make informed decisions based on reliable and comparable sustainability-related financial information.

What are the ISSB’s mandatory metrics?

The ISSB requires organizations to report key sustainability metrics, including:

- Greenhouse gas emissions across Scope 1, 2, and 3

- Emission intensity linked to financial and operational performance

- Exposure to sustainability-related risks, covering both physical and transition risks

- Climate-related financial planning, outlining how sustainability risks impact financial performance

- Investment in climate action, detailing funds allocated to sustainability initiatives

- Internal carbon pricing, explaining how carbon pricing is integrated into decision-making

- Climate-related executive remuneration, indicating the link between executive pay and sustainability performance

These mandatory metrics are designed to provide comparable information and globally comparable information, ensuring that investors and stakeholders have access to consistent, high-quality sustainability disclosures.

What are the benefits of ISSB standards?

The ISSB’s role is to provide a comprehensive global baseline for sustainability disclosures, benefiting companies and investors by:

- Enhancing sustainability matters transparency and comparability

- Improving integrated reporting for ESG factors

- Aligning with the IFRS Foundation and Value Reporting Foundation standards

- Supporting capital markets in making informed decisions

The widespread adoption of ISSB standards across various jurisdictions demonstrates their effectiveness and global relevance, as more regions commit to consistent and transparent sustainability disclosure practices.

What requirements does the ISSB have in terms of targets?

Companies must disclose:

- The nature of their targets, whether absolute or relative

- Baseline numbers used for measuring progress

- Time periods, distinguishing between interim and long-term targets

- Metrics for progress assessment, ensuring clear measurement

- Comparison with international agreements, such as the Paris Agreement

- Sectoral decarbonization approach, if applicable

- Third-party validation, confirming credibility

- Offsets accounting, detailing the use of carbon credits

Target-setting is a key component of sustainability-related disclosures, providing essential information for benchmarking and comparability across organizations. Clear and transparent target disclosures contribute to the evolving sustainability disclosure landscape, supporting high-quality, comparable reporting in line with global standards and regulatory expectations.

How will the ISSB work with other standards?

The ISSB collaborates with global organizations to promote interoperability. This includes aligning with:

- Global Reporting Initiative (GRI) for sustainability disclosures

- European Sustainability Reporting Standards (ESRS) for regulatory compliance

- SASB Standards for sector-specific sustainability reporting

- IFRS Sustainability Disclosure Taxonomy to streamline reporting

Implementing aligned sustainability disclosure standards across these frameworks is essential to ensure consistency and facilitate adoption by companies and jurisdictions.

What are the global implications of the ISSB?

The Corporate Sustainability Reporting Directive (CSRD) integrates ISSB standards but incorporates double materiality, ensuring companies assess both financial and societal sustainability impacts.

The UK government plans to adopt ISSB standards within company law and Financial Conduct Authority (FCA) requirements. The IFRS Foundation will play a key role in shaping disclosure rules.

Regulatory bodies, including the Canadian Securities Administrators (CSA), are aligning their frameworks with ISSB standards. In many jurisdictions, the integration of ISSB standards is closely linked with IFRS accounting standards, providing updated guidance and ensuring consistency with the latest global accounting practices. Even regions with differing regulations recognize the ISSB’s importance in sustainability matters and investor expectations.

How can companies prepare for the ISSB?

Businesses should:

- Familiarize themselves with ISSB’s frameworks, including IFRS Sustainability Disclosure Taxonomy

- Assess current sustainability disclosures and align with ISSB requirements

- Improve data collection on sustainability matters

- Establish robust governance for sustainability reporting

- Leverage Value Reporting Foundation guidelines for better alignment

How can sustainability software support ISSB data collection?

As ISSB standards require detailed and structured sustainability-related financial disclosures, companies need efficient tools to manage data collection and reporting. Sustainability software can support ISSB compliance by:

- Automating data gathering from various business operations

- Ensuring alignment with IFRS Sustainability Disclosure Standards

- Providing real-time tracking of sustainability performance

- Facilitating accurate reporting of ISSB-mandated sustainability metrics

- Enhancing risk assessment and scenario analysis for climate-related disclosures

By leveraging sustainability software, companies can streamline their reporting processes and ensure compliance with ISSB requirements while improving the quality and reliability of sustainability-related financial information.